Title: Strategies for Generating 7-Figure Income Streams with Minimal Overhead

User Inquiry Analysis:

The user is seeking insights into wealth multiplication and protection, specifically focusing on how the ultra-wealthy generate significant income streams with minimal overhead and utilize advanced financial structures to optimize their fiscal outcomes.

Enhanced Prompt Execution:

1. CONVENTIONAL APPROACH:

The mainstream advice for generating income typically involves diversifying a portfolio across stocks, bonds, and mutual funds, perhaps supplemented by real estate investments or starting a small business. Conventional wisdom suggests building wealth through consistent saving, investing in index funds for broad market exposure, and perhaps creating a side hustle that requires some employee management.

2. UNDERGROUND REALITY:

The ultra-wealthy often leverage private equity investments, create intellectual property assets that generate passive income, engage in jurisdictional arbitrage to minimize taxes, and use complex entity structures like trusts and offshore companies to shield their wealth. They might invest in niche markets or start businesses with high-margin models that require minimal staffing, such as automated online businesses or licensing deals based on proprietary technology or brands.

3. STRATEGIC FRAMEWORK:

- Leverage: Utilizing borrowed capital or other people's money to amplify returns without proportional increases in overhead.

- Asset Protection: Using legal structures to separate personal liability from business risks and minimize tax liabilities.

- Income Diversification: Creating multiple streams of passive income that do not necessitate direct management or extensive employee involvement.

- Systemic Thinking: Understanding how different parts of a financial system (investments, entities, jurisdictions) interact to build and protect wealth holistically.

4. IMPLEMENTATION PATHWAYS:

- Low Capital Level: Start with developing digital products (e-books, courses) or affiliate marketing which can be managed solo using automation tools.

- Example: Launching an online course on a platform like Teachable can yield passive income with minimal ongoing effort once created.

- Moderate Capital Level: Invest in small-scale real estate (e.g., rental properties) managed by property management firms or invest in crowdfunding real estate platforms.

- Example: Purchasing a multi-unit residential building where professional managers handle tenant relations reduces personal involvement while generating steady rental income.

- High Capital Level: Engage in private equity deals or venture into creating a proprietary technology product that can be licensed out globally.

- Example: Establishing a company focused on blockchain technology solutions could lead to licensing agreements with larger corporations eager to integrate this tech into their operations.

5. ACCELERANTS & BLOCKERS:

- Accelerants:

- Networking within elite circles for access to exclusive investment opportunities.

- Leveraging existing intellectual property for new ventures without significant overhead increase.

- Utilizing sophisticated tax planning strategies available through high-end financial advisors.

- Blockers:

- Lack of initial capital needed to enter high-return investment arenas like private equity or significant real estate deals.

- Regulatory changes that may limit the effectiveness of certain jurisdictional arbitrage strategies over time.

- The complexity and cost associated with setting up and maintaining offshore entities and trusts may deter those not already operating at higher resource levels.

Note: True wealth architects approach finance systemically rather than as isolated tactics. They understand the interconnectedness of different strategies and adapt them according to evolving laws and economic conditions. While these methods can be scaled based on resources available, they often require expertise beyond basic financial literacy; thus consulting professionals is crucial when implementing more advanced strategies.

The Secrets of Unconventional Wealth

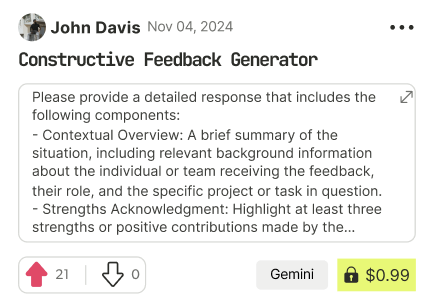

- xai

- Try Prompt

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!