Creating a Balanced Monthly Budget: Essentials, Entertainment, and Savings

To create a monthly budget that allows for saving money while still enjoying small luxuries, follow these steps and allocate your income into the following categories: essentials, entertainment, savings, and debt repayment.

Essentials (50-60% of monthly income)

1. Housing (rent/mortgage, utilities, insurance)

2. Food (groceries, dining out)

3. Transportation (car loan/gas/insurance, public transportation)

4. Insurance (health, disability, life)

5. Minimum debt payments (credit cards, loans)

6. Phone and internet bills

7. Subscription services (Netflix, gym membership)

Entertainment (10-20% of monthly income)

1. Hobbies (painting, playing an instrument, etc.)

2. Travel (local trips, weekend getaways)

3. Dining out (dates, special occasions)

4. Entertainment (movies, concerts, sporting events)

5. Gadgets and electronics

Savings (10-20% of monthly income)

1. Emergency fund (3-6 months' worth of expenses)

2. Retirement savings (401(k), IRA)

3. Short-term savings goals (down payment on a house, vacation)

4. Long-term savings goals (college fund, big purchases)

Debt Repayment (5-10% of monthly income)

1. Credit card debt

2. Personal loans

3. Student loans

Tips for Sticking to Your Budget:

1. Track your expenses: Use a budgeting app or spreadsheet to monitor your spending and identify areas for improvement.

2. Set financial goals: Prioritize your goals and allocate your savings accordingly.

3. Automate your savings: Set up automatic transfers from your checking account to your savings and investment accounts.

4. Avoid impulse purchases: Create a 30-day waiting period for non-essential purchases to help you avoid buying on impulse.

5. Review and adjust: Regularly review your budget and make adjustments as needed to stay on track.

Example Budget Allocation:

Assuming a monthly income of $4,000, here's an example budget allocation:

Essentials: $2,400 (60% of monthly income)

+ Housing: $1,200 (30% of monthly income)

+ Food: $600 (15% of monthly income)

+ Transportation: $400 (10% of monthly income)

+ Insurance: $200 (5% of monthly income)

Entertainment: $400 (10% of monthly income)

+ Hobbies: $100

+ Travel: $100

+ Dining out: $100

+ Entertainment: $100

Savings: $800 (20% of monthly income)

+ Emergency fund: $400

+ Retirement savings: $200

+ Short-term savings goals: $100

+ Long-term savings goals: $100

Debt Repayment: $200 (5% of monthly income)

+ Credit card debt: $100

+ Personal loans: $50

+ Student loans: $50

Remember, this is just a sample budget, and you should adjust the categories and allocations based on your individual needs and financial goals.

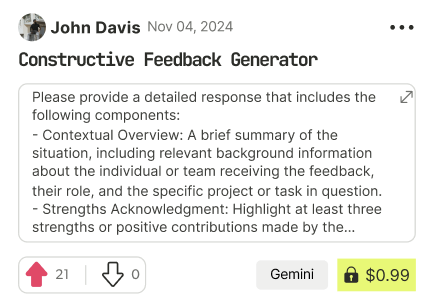

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!