Recession-Proofing Strategy for Automotive Retiree

Threat Assessment:

Your current financial posture presents significant vulnerabilities, designated as critical failure points in the face of a severe recession. Retirement on a fixed pension of $1,800 is a fragile single income stream, especially given pension fund instability during economic turmoil. Your $60,000 savings, while appearing substantial, is a thin line of defense against prolonged unemployment or pension disruption if not strategically deployed. The bookstore operated by your spouse represents a highly exposed economic outpost, susceptible to immediate revenue collapse in a downturn. Your negligible and poorly performing investment portfolio is a missed opportunity for financial fortification and offers no buffer against market shocks. While home ownership eliminates mortgage risk, property taxes and maintenance are fixed liabilities eroding savings during income stress. In essence, your current financial defense system is akin to a Maginot Line – seemingly strong but easily circumvented by modern economic warfare.

Strategic Priorities:

1. Immediate Fortification of Emergency Reserves: Establish a robust cash buffer to withstand income disruption. (Urgency: Critical)

2. Aggressive Expenditure Reduction & Resource Repositioning: Implement "economic doomsday" budgeting to minimize cash outflow and maximize savings. (Urgency: Critical)

3. Income Diversification Offensive: Develop and deploy recession-resistant income streams to reduce reliance on vulnerable sources. (Urgency: High)

4. Strategic Investment Realignment: Re-evaluate and reposition investment assets for capital preservation and opportunistic growth during market downturns. (Urgency: Medium)

5. Bookstore Operational Redesign & Contingency Planning: Enhance bookstore resilience or prepare for strategic retreat and alternative deployment of spouse's skills. (Urgency: Medium)

6. Psychological Armor Deployment: Develop mental fortitude and disciplined decision-making protocols to navigate financial panic. (Urgency: Ongoing)

Tactical Implementation:

1. Emergency Reserve Fortification (Operation: Ironclad Savings):

- Threat Addressed: Pension disruption, bookstore closure, prolonged unemployment, unexpected recessionary expenses.

- Implementation:

- Phase 1: Doomsday Budget Deployment (Timeline: Within 7 Days): Institute an "economic doomsday budget." Reduce monthly expenses to absolute bare minimum. Target: $1,500/month (essential living costs + reduced property tax/maintenance). Identify and eliminate all non-essential spending categories (dining out, entertainment, subscriptions, etc.). Achieve immediate 30-40% expense reduction.

- Phase 2: Savings Mobilization (Timeline: Within 14 Days): Calculate target emergency fund: 24 months of doomsday budget expenses = $36,000. Your current $60,000 exceeds this minimum, but aim for a higher reserve of $72,000 (36 months) for maximum fortification. Immediately transfer $36,000 from low-yield accounts to High-Yield Savings Accounts (HYSAs) or short-term, high-quality Certificate of Deposits (CDs) for enhanced yield while maintaining liquidity. Retain $24,000 in easily accessible savings for immediate needs.

- Phase 3: Continuous Ammunition Stockpiling (Timeline: Ongoing): Direct all freed-up cash flow from expense reduction and new income streams into emergency reserves until target of $72,000 is reached. Continuously monitor and replenish reserves to maintain fortress-grade protection.

- Resilience Outcome:

- Mild Recession: Emergency fund provides a comfortable 2-3 year buffer, ensuring financial stability even with temporary pension reductions or bookstore downturn.

- Severe Recession: Provides a critical lifeline during prolonged unemployment or significant pension cuts, preventing forced asset liquidation at depressed prices. Buys time to adapt and redeploy resources.

2. Expenditure Reduction & Resource Repositioning (Operation: Austerity Shield):

- Threat Addressed: Rapid depletion of savings during recession, reduced cash flow, need to maximize resource longevity.

- Implementation:

- Phase 1: Expenditure Reconnaissance (Timeline: Immediate): Meticulously track all household spending for 1 week. Categorize every expense as "Mission Critical" (essential survival) or "Expendable Assets" (non-essential).

- Phase 2: Non-Essential Asset Elimination (Timeline: Within 7 Days): Brutally eliminate all "Expendable Assets." Negotiate lower rates for essential services (utilities, insurance). Consider downsizing non-essential assets (vehicles, unnecessary possessions) to generate immediate cash injection. Target: Additional $300-$500 monthly expense reduction beyond initial doomsday budget.

- Phase 3: Resource Repositioning (Timeline: Ongoing): Continuously monitor and refine budget. Identify further cost-saving measures. Repurpose freed-up funds into emergency reserves and income diversification initiatives.

- Resilience Outcome:

- Mild Recession: Maximizes savings rate, strengthens emergency fund faster, reduces financial strain, allowing for proactive opportunities.

- Severe Recession: Significantly extends emergency fund runway, provides crucial breathing room to adapt to prolonged downturn, minimizes forced asset liquidation.

3. Income Diversification Offensive (Operation: Multiple Fronts):

- Threat Addressed: Over-reliance on vulnerable pension income, bookstore revenue collapse, need for recession-resistant cash flow.

- Implementation:

- Phase 1: Skillset Assessment & Market Reconnaissance (Timeline: Within 14 Days): Analyze your 25 years of middle management experience. Identify transferable skills applicable to recession-resistant sectors (e.g., remote project management, online customer service, consulting for essential industries, online education). Spouse to assess bookstore skills transferable to online retail, freelance writing/editing related to books, virtual assistant services. Research in-demand, recession-proof part-time/freelance opportunities.

- Phase 2: Income Stream Deployment (Timeline: Within 30 Days): Actively pursue part-time/freelance work in identified sectors. Leverage online platforms (Upwork, Fiverr, LinkedIn) to market skills. Spouse to initiate online bookstore sales, explore virtual book club hosting, or related online services. Target: Generate at least $1,000/month in combined new income streams within 3-6 months.

- Phase 3: Income Stream Expansion (Timeline: Ongoing): Continuously seek to expand and diversify income streams. Re-invest profits from new income sources into further diversification efforts or emergency reserves.

- Resilience Outcome:

- Mild Recession: Provides significant supplemental income, offsetting any pension reductions or bookstore revenue decline, accelerating emergency fund growth.

- Severe Recession: Creates essential alternative income if pension is severely cut or bookstore fails. Reduces financial desperation, provides crucial survival cash flow.

4. Strategic Investment Realignment (Operation: Capital Shield):

- Threat Addressed: Market crash eroding savings, inflation risk, missed opportunity to capitalize on market downturns.

- Implementation:

- Phase 1: Portfolio Liquidation & Consultation (Timeline: Within 7 Days): Immediately liquidate poorly performing local stock recommendations. Seek consultation from a CERTIFIED FINANCIAL PLANNER (CFP) who is a fiduciary and fee-only. Do NOT rely on advice from friends or commission-based brokers.

- Phase 2: Defensive Portfolio Repositioning (Timeline: Within 30 Days): Based on CFP advice and your risk tolerance, reposition remaining investment assets. In a recessionary environment, prioritize capital preservation. Consider a portfolio allocation that is more conservative: higher allocation to high-quality bonds and cash equivalents, lower allocation to stocks. Explore low-cost, diversified index funds (e.g., bond index funds, dividend-focused stock funds).

- Phase 3: Opportunistic Deployment (Timeline: Ongoing): With CFP guidance, develop a strategy for gradually and strategically deploying capital into the stock market during downturns using Dollar-Cost Averaging (DCA) – investing fixed amounts at regular intervals to reduce risk of market timing. Focus on long-term value investing, not speculative trading.

- Resilience Outcome:

- Mild Recession: Protects capital from significant market downturns, minimizes losses, positions for long-term recovery.

- Severe Recession: Minimizes portfolio erosion, preserves capital for opportunistic buying during market bottoms, potential for significant long-term gains during recovery phase.

5. Bookstore Operational Redesign & Contingency Planning (Operation: Retail Bastion):

- Threat Addressed: Bookstore revenue collapse, business failure, loss of spouse's income.

- Implementation:

- Phase 1: Operational Stress Test (Timeline: Within 14 Days): Conduct a brutal assessment of bookstore financials, market trends, and competitive landscape. Identify critical vulnerabilities and unsustainable operational costs.

- Phase 2: Fortress Reinforcement or Strategic Retreat (Timeline: Within 30 Days):

- Reinforcement (If Viable): Implement aggressive cost-cutting measures (reduce inventory, negotiate rent reduction, optimize staffing). Pivot to online sales channels aggressively. Develop unique, recession-resistant offerings (e.g., online book clubs, writing workshops, curated subscription boxes). Explore partnerships with complementary businesses.

- Strategic Retreat (If Unsustainable): Develop a phased closure plan if bookstore viability is deemed unsustainable. Focus on liquidating inventory strategically. Spouse to redeploy skills towards recession-resistant online retail, freelance work, or part-time employment.

- Phase 3: Contingency Deployment (Timeline: Ongoing): If reinforcement fails, execute strategic retreat plan swiftly and decisively. Spouse to aggressively pursue alternative income streams developed in Operation: Multiple Fronts.

- Resilience Outcome:

- Mild Recession: Improved bookstore resilience through cost reduction and online pivot, increased survival chances.

- Severe Recession: Maximizes bookstore survival if reinforcement is successful. If closure is unavoidable, contingency plan ensures minimal income disruption for spouse, avoiding total financial collapse.

6. Psychological Armor Deployment (Operation: Mental Fortress):

- Threat Addressed: Panic-driven financial decisions, emotional paralysis, impaired judgment during financial stress.

- Implementation:

- Phase 1: Information Warfare Defense (Timeline: Immediate): Limit exposure to sensationalist financial media and fear-mongering narratives. Rely on credible, data-driven sources for economic information.

- Phase 2: Tactical Information Gathering (Timeline: Ongoing): Establish a regular financial review schedule (weekly, monthly) to stay informed and in control of your situation. Monitor key economic indicators and your portfolio performance objectively.

- Phase 3: Mental Discipline & Support Systems (Timeline: Ongoing): Develop stress-management techniques (exercise, mindfulness, hobbies). Maintain open and honest communication with your spouse about financial situation and strategy. Seek support from a financial advisor or therapist if needed to manage emotional stress and maintain clear decision-making.

- Resilience Outcome:

- Mild Recession: Maintains calm and rational decision-making, avoids panic selling or impulsive financial actions, enhances proactive problem-solving.

- Severe Recession: Provides critical mental fortitude to navigate extreme financial stress, prevents emotional paralysis or self-destructive behaviors, maintains strategic clarity under pressure.

Resilience Simulation:

(See detailed resilience outcomes within each Tactical Implementation section above.)

In summary, this multi-layered recession-proofing strategy provides significant financial fortification against various recession severity scenarios. It shifts your financial posture from a vulnerable outpost to a well-defended fortress, prioritizing resource conservation, income diversification, and strategic capital deployment. While no strategy guarantees immunity to economic shocks, this plan dramatically increases your resilience and survival odds in the face of a severe downturn.

Next Briefing:

For the next briefing, I require the following intelligence to further refine your recession-proofing strategy:

1. Detailed Breakdown of Current Monthly Expenses: Provide a categorized list of all current monthly expenses, clearly differentiating between "Mission Critical" and "Expendable Assets."

2. Spouse's Bookstore Financials: Provide detailed financial statements for the bookstore, including revenue trends, operating costs, and current debt obligations (if any).

3. Specific Skills Inventory: List specific skills and experience for both yourself and your spouse that could be leveraged for income diversification, especially in recession-resistant sectors.

4. Pension Fund Details: Provide any available information regarding the financial health and stability of your pension fund.

5. Risk Tolerance Assessment: Describe your comfort level with financial risk and your investment knowledge to further tailor the investment strategy.

With this additional intelligence, we can fine-tune your recession-proofing strategy into an even more precise and effective financial defense system.

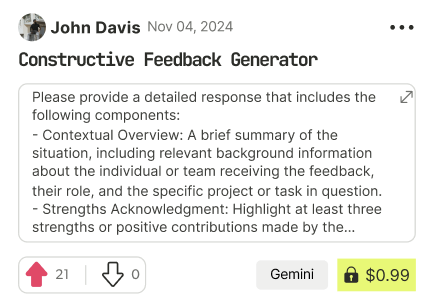

Recession-Proof Survival Architect

- gemini

- Try Prompt

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!