Mastering Your Finances: 10 Essential Tips for Creating and Maintaining a Personal Budget

As a personal finance expert with over 15 years of experience, I've compiled 10 practical tips to help individuals create and maintain an effective and sustainable personal budget. These tips focus on strategies for saving money, reducing debt, and planning for future expenses, ensuring clarity and simplicity in their explanations.

1. Track Your Expenses: Understanding where your money goes is crucial in creating a realistic budget. For one month, write down every single transaction, including small purchases like coffee or snacks. This will help you identify areas where you can cut back and allocate funds more efficiently.

2. Set Financial Goals: Determine what you want to achieve with your budget, whether it's paying off debt, saving for a down payment on a house, or building an emergency fund. Having clear goals will help you stay motivated and focused on your financial objectives.

3. Use the 50/30/20 Rule: Allocate 50% of your income towards necessary expenses like rent, utilities, and groceries. Use 30% for discretionary spending like entertainment and hobbies, and 20% for saving and debt repayment.

4. Prioritize Needs Over Wants: Distinguish between essential expenses and discretionary spending. Be honest with yourself – do you really need that new designer handbag, or can you live without it?

5. Automate Your Savings: Set up automatic transfers from your checking account to your savings or investment accounts. This way, you'll ensure consistent saving without having to think about it.

6. Pay Off High-Interest Debt: Focus on eliminating high-interest debt, such as credit card balances, as soon as possible. Consider consolidating debt into a lower-interest loan or balance transfer credit card.

7. Use Budgeting Tools: Take advantage of budgeting apps like Mint, You Need a Budget (YNAB), or Personal Capital to track your expenses, create a budget, and set financial goals.

8. Build an Emergency Fund: Aim to save 3-6 months' worth of living expenses in an easily accessible savings account. This fund will help you cover unexpected expenses and avoid going into debt.

9. Review and Adjust: Regularly review your budget to ensure you're on track to meet your financial goals. Adjust your spending habits and budget categories as needed to stay on course.

10. Avoid Lifestyle Inflation: As your income increases, avoid the temptation to inflate your lifestyle by spending more on luxuries. Instead, direct excess funds towards saving, debt repayment, or long-term investments.

By following these 10 practical tips, you'll be well on your way to creating and maintaining a personal budget that helps you achieve financial stability and success.

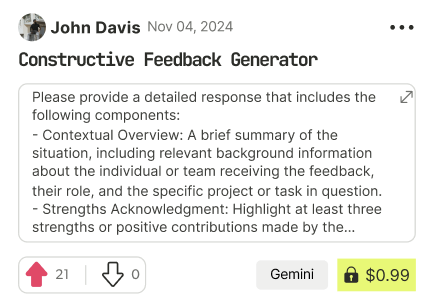

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!