Okay, let's get started on your journey to financial freedom. I've helped countless individuals transform their financial lives, and I'm confident we can do the same for you.

Personalized Wealth-Building Strategy: From Broke to Abundance

First, I need to simulate an analysis of your current financial habits, since I don't have access to your personal data. For the purpose of this exercise, I'll make some common assumptions, and you can adjust the plan later based on your actual situation. This is crucial – this plan is a template, and its success depends on you plugging in your real numbers.

Assumed Starting Point (You'll need to replace these with your REAL numbers):

Income: $4,000/month (net, after taxes)

Expenses: $3,500/month (rent, food, transportation, utilities, entertainment, etc.)

Debt: $5,000 credit card debt at 18% APR, $20,000 student loan at 6% APR

Savings: $500 in a checking account

Investments: None

Part 1: Rethinking Money – The Uncommon Mindset

Most people view money as a tool for consumption. They earn it, spend it, and often run out before the next paycheck. The wealthy, however, view money as a tool for creation and leverage. Here's the shift in perspective:

1. Money is a Seed: Every dollar you have is not just a dollar; it's a potential seed that can grow into more dollars. Your goal isn't just to spend it; it's to plant it (invest it) so it can produce a harvest (returns).

2. Assets vs. Liabilities: Understand the fundamental difference. Assets put money in your pocket (e.g., investments, rental properties, businesses). Liabilities take money out of your pocket (e.g., consumer debt, depreciating cars). Focus on acquiring assets, not liabilities.

3. Time is Your Greatest Asset: Compound interest is the eighth wonder of the world. The earlier you start investing, even small amounts, the more powerful it becomes. Time in the market beats timing the market.

4. Value Creation: Wealth is created by providing value to others. The more value you create, the more wealth you can accumulate. Think about your skills, talents, and how you can use them to solve problems for others.

5. Delayed Gratification: This is the cornerstone of wealth building. It's the ability to resist the urge to spend now in order to achieve greater financial rewards later.

6. Financial Literacy is Non-Negotiable: You must understand basic financial concepts like budgeting, investing, debt management, and taxes. This isn't optional.

Part 2: Building Wealth with Minimal Risk

"Minimal risk" doesn't mean "no risk." All investments carry some degree of risk. The key is to manage and mitigate that risk intelligently. Here's a low-risk approach:

1. Emergency Fund First: Before you even think about investing, build a 3-6 month emergency fund in a high-yield savings account (HYSA). This is your safety net, and it prevents you from going into debt when unexpected expenses arise. This is not an investment; it's insurance.

2. Debt Demolition (High-Interest First): Aggressively pay down high-interest debt, like the assumed credit card debt. Use the "debt snowball" (pay minimums on all debts except the smallest, then attack that one) or "debt avalanche" (pay minimums on all debts except the highest interest, then attack that one) method. The avalanche method saves more money in the long run.

3. Index Fund Investing (The Core of Your Portfolio): Once high-interest debt is gone, start investing in low-cost, broad-market index funds or ETFs (Exchange Traded Funds). These track a specific market index (like the S&P 500), providing diversification and reducing risk. Examples include:

Vanguard Total Stock Market ETF (VTI): Exposure to the entire U.S. stock market.

Vanguard S&P 500 ETF (VOO): Exposure to the 500 largest U.S. companies.

iShares Core S&P 500 ETF (IVV): Another S&P 500 tracker.

Vanguard Total International Stock ETF (VXUS): Exposure to international stocks.

Do not try to pick individual stocks until you have significantly more experience and a much larger portfolio.

4. Dollar-Cost Averaging (DCA): Invest a fixed amount of money regularly (e.g., monthly), regardless of market fluctuations. This reduces the risk of investing a large sum at a market peak.

5. Rebalancing: Periodically (e.g., annually), adjust your portfolio to maintain your desired asset allocation. If stocks have outperformed bonds, sell some stocks and buy bonds to get back to your target allocation.

6. Don't Panic Sell: Market downturns are inevitable. Don't let fear drive your investment decisions. Stay the course, and remember that you're investing for the long term.

7. Tax-Advantaged Accounts: Maximize contributions to tax-advantaged retirement accounts like 401(k)s (especially if your employer offers matching contributions – that's free money!) and Roth IRAs. These accounts offer significant tax benefits that accelerate wealth growth.

Part 3: Creating Multiple Streams of Income

Diversifying your income sources is crucial for financial security and accelerating wealth building. Here are some ideas, ranging from simple to more complex:

1. "Side Hustle" Your Skills: What are you good at? Can you offer freelance services (writing, editing, design, programming, consulting, tutoring, etc.)? Platforms like Upwork, Fiverr, and TaskRabbit can connect you with clients.

2. Rent Out Assets: Do you have a spare room, a car you don't use often, or other assets you can rent out? Airbnb, Turo, and other platforms make this easier than ever.

3. Affiliate Marketing: If you have a blog, social media following, or email list, you can promote other companies' products and earn a commission on sales.

4. Create and Sell Digital Products: Ebooks, online courses, templates, and other digital products can be created once and sold repeatedly. Platforms like Gumroad, Teachable, and Udemy can help.

5. Dividend Investing: Once your core index fund portfolio is established, you can consider adding dividend-paying stocks or ETFs. These provide a regular income stream.

6. Real Estate (Long-Term): As you accumulate more capital, real estate can be a powerful wealth-building tool. This could involve rental properties, house flipping (higher risk), or real estate investment trusts (REITs). Start small and learn the ropes before making large investments.

7. Start a Small Business (Long-Term, Higher Risk/Reward): If you have an entrepreneurial spirit and a solid business idea, starting a small business can be a path to significant wealth. This requires significant time, effort, and risk management.

Part 4: Step-by-Step Wealth-Building Plan (Based on Assumed Starting Point)

This plan uses the assumed starting point. You MUST adapt it to your own financial situation.

Phase 1: Financial Triage (Months 1-6)

1. Track Every Penny: Use a budgeting app (Mint, YNAB, Personal Capital) or a spreadsheet to track every dollar you earn and spend for one month. This is crucial for understanding your cash flow.

2. Create a Realistic Budget: Based on your tracking, create a budget that prioritizes needs over wants. Allocate funds for:

Needs (50%): Housing, food, transportation, utilities, insurance.

Wants (30%): Entertainment, dining out, hobbies.

Savings & Debt Repayment (20%): Emergency fund, debt payments, investments.

These percentages are guidelines; adjust as needed.

3. Cut Expenses: Identify areas where you can reduce spending. Can you negotiate bills, cook more at home, or find cheaper alternatives for entertainment?

4. Build a $1,000 Mini-Emergency Fund: This is your initial safety net.

5. Attack High-Interest Debt: Focus on paying down the credit card debt aggressively. Using the assumed numbers, and the $500/month surplus, plus the initial $500 savings, you could potentially pay off a significant chunk within 6 months. Calculate this based on your actual debt and surplus.

Phase 2: Building a Foundation (Months 7-18)

1. Complete Emergency Fund: Build your emergency fund to 3-6 months of living expenses. Using the assumed $3,500/month expenses, this would be $10,500 - $21,000.

2. Continue Debt Repayment: Keep paying down the student loan, but the priority shifts to the emergency fund once the credit card is paid off.

3. Start Investing: Once the emergency fund is complete and high-interest debt is gone, begin investing in a low-cost index fund (like VTI or VOO) through a brokerage account (Vanguard, Fidelity, Schwab). Start with a small amount, like $100/month, and increase it as your income and surplus grow.

4. Open and Contribute to Tax Advantaged Accounts: Prioritize any employer match, then consider a Roth IRA.

Phase 3: Accelerating Wealth (Months 19+)

1. Increase Investment Contributions: Gradually increase your investment contributions as your income grows and your debt shrinks. Aim to invest at least 15-20% of your income.

2. Explore Additional Income Streams: Start exploring the income diversification strategies outlined in Part 3. Begin with low-risk options like freelancing or renting out assets.

3. Continue Learning: Read books, take courses, and follow financial experts to expand your knowledge of personal finance and investing.

4. Rebalance Portfolio Annually: Ensure your asset allocation remains aligned with your risk tolerance and goals.

5. Consider Real Estate or Business Ventures (Long-Term): Once you have a solid financial foundation and significant experience, you can explore more advanced wealth-building strategies.

Important Considerations:

This is a long-term game. Wealth building takes time, discipline, and consistency. Don't get discouraged by slow progress in the beginning.

Adjust the plan as needed. Life happens. Your income, expenses, and goals will change over time. Be flexible and adapt your plan accordingly.

Seek professional advice if needed. If you feel overwhelmed or need personalized guidance, consider consulting a fee-only financial advisor.

Automate Everything: Set up automatic transfers for savings, debt payments, and investments. This makes it easier to stay on track.

This plan provides a framework. Your success depends on your commitment to implementing it and adapting it to your unique circumstances. Replace the assumed numbers with your own, and start taking action today! Good luck!

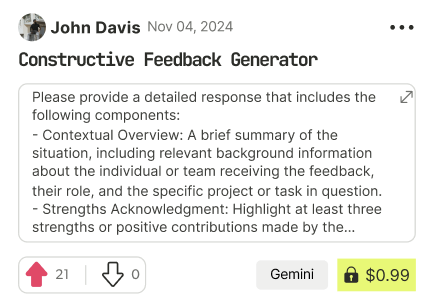

Master Money Like a Billionaire

- gemini

- Try Prompt

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!