Comprehensive Financial Planning: A Step-by-Step Guide to Achieving Your Goals

As your financial advisor, I'll guide you through a structured process to create a personalized plan for achieving your specific financial goal. Let's assume your goal is to save $20,000 in the next 12 months. We'll break down this goal into manageable steps and provide you with the necessary tools and strategies to stay on track.

Financial Audit: Evaluating Your Current Financial Standing

To understand where you stand, we need to evaluate your current financial situation. Please gather the following information:

1. Income: Calculate your total monthly income from all sources, including salaries, investments, and any side hustles.

2. Fixed Expenses: List your monthly fixed expenses, such as rent/mortgage, utilities, car loan/lease, insurance, and minimum credit card payments.

3. Variable Expenses: Track your variable expenses, including groceries, entertainment, travel, and hobbies, for the past 3-6 months.

4. Debt: List all your debts, including credit cards, personal loans, and mortgages, along with their interest rates and minimum payments.

5. Savings: Calculate your current savings rate and total savings amount.

Financial Audit Template:

| Category | Monthly Amount |

| --- | --- |

| Income | $_____________ |

| Fixed Expenses | $_____________ |

| Variable Expenses | $_____________ |

| Debt | $_____________ |

| Savings | $_____________ |

Goal Breakdown: Monthly and Weekly Savings Targets

To achieve your goal of saving $20,000 in 12 months, we'll break it down into smaller, manageable targets.

1. Monthly Savings Target: $20,000 / 12 months = $1,667 per month

2. Weekly Savings Target: $1,667 / 4 weeks = $417 per week

Goal Breakdown Template:

| Goal | Monthly Target | Weekly Target |

| --- | --- | --- |

| Save $20,000 | $1,667 | $417 |

Resource Recommendations:

To manage and grow your finances, consider the following tools and apps:

1. Budgeting Apps: Mint, You Need a Budget (YNAB), or Personal Capital

2. Savings Apps: Qapital, Digit, or Acorns

3. Investment Platforms: Robinhood, Vanguard, or Fidelity

4. Credit Monitoring: Credit Karma or Experian

Accountability Strategies:

To maintain focus and stay on track:

1. Automate Savings: Set up automatic transfers from your checking account to your savings or investment accounts.

2. Set Reminders: Schedule weekly or bi-weekly reminders to review your progress and adjust your spending habits.

3. Accountability Partner: Share your goals with a trusted friend or family member and ask them to hold you accountable.

Motivation Tactics:

To visualize your progress and stay motivated:

1. Vision Board: Create a visual representation of your goals and track your progress.

2. Savings Thermometer: Create a thermometer chart to track your savings progress.

3. Celebrate Milestones: Celebrate your progress along the way, such as reaching 25% or 50% of your goal.

Budgeting and Tracking Progress Templates:

1. 50/30/20 Budget Template:

| Category | Allocation |

| --- | --- |

| Essential Expenses (50%) | $_____________ |

| Non-Essential Expenses (30%) | $_____________ |

| Savings and Debt Repayment (20%) | $_____________ |

2. Weekly Expense Tracker:

| Day | Category | Expense |

| --- | --- | --- |

| Monday | Groceries | $_____________ |

| Tuesday | Entertainment | $_____________ |

| ... | ... | ... |

By following these steps and using the provided templates, you'll be well on your way to achieving your financial goal. Remember to review and adjust your plan regularly to ensure you're staying on track.

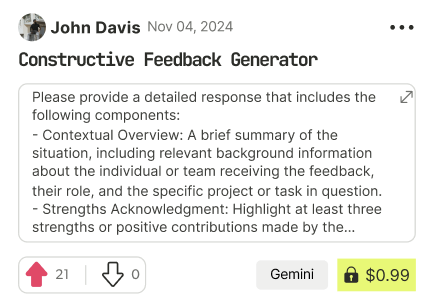

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!