Antifragile Portfolio Resilience for Early Retirement

Portfolio Vulnerability Analysis:

Your current allocation (60% equities, 30% bonds, 10% cash) has provided growth and income stability, but it lacks exposure to inflation hedges and alternative assets. The heavy reliance on traditional asset classes leaves your portfolio vulnerable to stagflation scenarios reminiscent of the 1970s and liquidity risks during a 2008-like systemic collapse. Equities might suffer in severe downturns, bonds face interest rate and inflation pressures, and cash may erode in real value during periods of high inflation.

Economic Exposure Mapping:

• Stagflation Concerns: In a rising inflation and stagnant growth environment, both equities and conventional bonds can underperform. Although dividend-paying stocks provide cash flow, they may not always cover inflation losses during prolonged economic stress.

• Crisis Resilience: A 2008-like market crash can lead to depressed asset values right when liquidity is vital. Without alternatives such as gold, real assets, or inflation-protected securities, the portfolio might lack the necessary defense against systemic shocks.

• Opportunity Cost: While staying fully invested in equities offers growth, it potentially sacrifices the balance that alternative assets can provide in turbulent times. Diversifying with non-correlated assets can smooth returns over time without resorting to day trading or leverage.

Resilience Recommendations:

1. Introduce Inflation Hedges: Allocate a portion (e.g., 5-10% of the total portfolio) to gold, precious metals, or commodity-linked ETFs. Historically, these assets have acted as a store of value during periods of rampant inflation.

2. Adopt Inflation-Protected Securities: Consider shifting part of the bond allocation into Treasury Inflation-Protected Securities (TIPS) or similar instruments to help maintain purchasing power during inflationary bursts.

3. Diversify into Alternative Investments: Add a modest allocation (e.g., 5-10%) to alternative investments such as real estate investment trusts (REITs) or infrastructure funds. These can provide both steady income and inflation resilience.

4. Sector Rotation and Defensive Stocks: Within your equity portion, emphasize defensive sectors (consumer staples, utilities, healthcare) that tend to perform better during economic slowdowns, while allowing for some exposure to growth companies with strong dividend histories.

5. Liquidity Management: Ensure you maintain sufficient liquid assets—potentially a slightly higher cash buffer or easily liquidated equivalents—to fund annual withdrawals without being forced to sell during market lows.

6. Regular Review and Dynamic Allocation: Implement periodic (e.g., annual or semi-annual) stress tests of your portfolio composition. Utilize up-to-date market data sources and the latest economic indicators (by consulting trusted financial news and market research platforms) to make tactical adjustments guided by risk management principles.

7. Risk-Adjusted Implementation: Each recommendation should be implemented with caution: evaluate historical performance (e.g., the protective role of gold during inflationary periods, performance of TIPS in high-inflation regimes) and assess the risk-reward trade-offs relevant to your retirement timeline.

This strategy integrates economic scenario analysis, historical case studies, and a robust risk management framework. By diversifying across asset classes and incorporating hedges against both inflation and downturns, you are preparing for scenarios that could threaten purchasing power and liquidity. It’s crucial to emphasize risk management and diversification over chasing absolute returns. Please consult with a certified financial planner or wealth strategist to tailor these strategies to your individual circumstances.

Finance Fortress: Recession-Proof Your Nest Egg

- openai

- Try Prompt

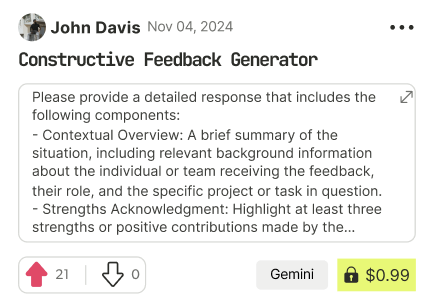

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!