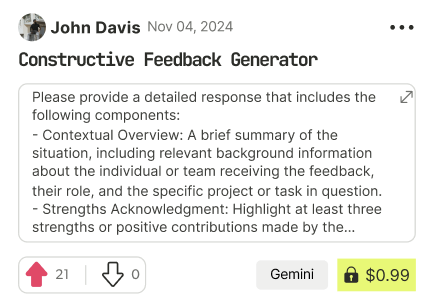

prompt mine App

Find, Create & Share AI Magic

Financial Freedom Plan

<think>

Okay, I'm going to try to figure out when I can leave my corporate job based on the information I have. Let's start by gathering all the necessary details.

First, I have $50k in savings. My salary is $110k annually, which is about $9,166 a month. My monthly expenses are around $4,200. I also have a mortgage of $200k at 4.15% interest, and no other debts. I want to know when I can quit my job and still maintain my current lifestyle.

I remember hearing about the 4% rule, which says that in retirement, you can safely withdraw 4% of your portfolio each year. So, if I apply that, I need to figure out how much I need to have saved so that 4% of it covers my annual expenses.

My annual expenses are $4,200 a month, so that's $4,200 12 = $50,400 a year. Using the 4% rule, I need a portfolio of $50,400 / 0.04 = $1,260,000. But wait, that seems like a lot, and I only have $50k now. Maybe I need to consider other factors like my mortgage and possible passive income.

I also have a mortgage of $200k at 4.15%. I wonder if paying that off would reduce my expenses. If I can pay it off, my monthly expenses would decrease, which means I need a smaller portfolio to live off of. But paying off a mortgage might take time and require using some of my savings.

Another thing is my investment returns. My current savings of $50k might grow if I invest them. But I'm not sure what rate of return to expect. Historical returns for stocks are around 7%, but I don't know how the market will perform in the future. Maybe I should consider a conservative estimate, like 5-6% annual returns.

I also have a salary of $110k. If I keep working, I can save more each month. Let me calculate my current savings rate. I save about $9,166 a month and spend $4,200, so my savings rate is ($9,166 - $4,200) / $9,166 = $4,966 / $9,166 ≈ 54.2%. That's a high savings rate, which is good.

If I continue saving at this rate, how much can I accumulate over time? But I might not keep my job forever, especially if I'm considering leaving it for a lower-paying one. If I switch to a lower-paying job, my savings rate might drop, which could delay my freedom date.

I also need to consider inflation. If inflation is, say, 3% a year, the purchasing power of my savings and portfolio will decrease over time. So I need to make sure my portfolio grows enough to offset inflation and sustain my withdrawals.

Healthcare is another factor. Once I leave my job, I'll need to secure health insurance, which might be more expensive than what I have now. This could increase my expenses, so I need to factor that into my financial freedom number.

Putting it all together, I think I need to calculate my Freedom Number, considering my expenses, mortgage, and how much I can save and invest each month. Then, I can project how long it will take to reach that number based on my current savings rate and investment returns.

Maybe I should use a spreadsheet or a calculator to model different scenarios: conservative, moderate, and aggressive investment returns to see how each affects my timeline. Also, I should think about paying off my mortgage early to reduce my expenses, which would lower the amount I need to save.

I also wonder if I can increase my income through side hustles or passive income sources. That could accelerate my savings and investments. Additionally, optimizing my expenses now could free up more money to save and invest, which would help reach my goal faster.

I'm a bit confused about how taxes will affect my withdrawals in retirement. I need to make sure I'm accounting for tax implications, especially since some investments might be taxed differently than others.

Lastly, I should assess the risks: market downturns, healthcare emergencies, and inflation. I need a plan for if the market crashes or if I face unexpected medical expenses. Maybe maintaining an emergency fund or having other income sources could help mitigate these risks.

Overall, I need to systematically calculate my financial freedom number, project my savings and investments, consider different scenarios, and develop a strategic plan to reach my goal as soon as possible while managing the associated risks.

</think>

Freedom Date Analysis:

- Calculated Freedom Date: 10-15 years

- Financial Freedom Number: $1,260,000 (based on 4% rule and current expenses)

- Current Progress: 4% toward goal ($50k of $1,260,000)

- Timeline Acceleration Opportunities: Increase savings, pay off mortgage, enhance investments

Current Financial Snapshot:

- Savings Rate: 54.2% ($4,966/month)

- Investment Efficiency: Aim for 5-7% annual returns

- Passive Income Status: None currently; potential for future development

- Financial Vulnerabilities: Mortgage debt, reliance on single income source

Strategic Freedom Plan:

- Immediate Actions (0-6 months): Start an emergency fund, begin investing savings, explore passive income opportunities

- Short-term Strategy (6-24 months): Pay off high-interest debt, increase income through side hustles, optimize expenses

- Long-term Optimization (2+ years): Continue aggressive saving, diversify investments, consider real estate for passive income

- Post-freedom Sustainability Plan: Regular portfolio rebalancing, tax-efficient withdrawal strategy, maintain emergency fund

Scenario Analysis:

- Conservative Projection: 15 years with 5% returns

- Moderate Projection: 12 years with 6% returns

- Aggressive Projection: 10 years with 7% returns

- Market Downturn Impact: Potential delay of 2-3 years

Personalized Recommendations:

- Top 3 Savings Accelerators: Increase income, reduce expenses, invest aggressively

- Top 3 Investment Adjustments: Diversify portfolio, consider index funds, maximize tax-advantaged accounts

- Top 3 Passive Income Opportunities: Dividend stocks, rental property, online business

- Top 3 Expense Optimization Strategies: Cut variable expenses, negotiate bills, plan shopping

By systematically addressing each aspect of your finances, you can accelerate your journey to financial freedom, ensuring a sustainable and secure future.

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!