Financial Planning Mastery for Small Business Owners

As a small business owner, optimizing your financial planning can be the difference between success and stagnation. In this thread, we'll dive into advanced strategies for tax optimization, scalable budgeting, and leveraging financial software for forecasting.

1/8 Tax Optimization

Did you know that tax planning can save your business thousands of dollars? Focus on these key areas:

Accrual accounting: Match income and expenses for a clearer financial picture.

Depreciation: Maximize asset write-offs to reduce taxable income.

Tax credits: Claim credits for research and development, renewable energy, or hiring veterans.

2/8 Scalable Budgeting Techniques

As your business grows, so should your budget. Implement these techniques:

Zero-based budgeting: Start from scratch each period, allocating funds based on business needs.

50/30/20 rule: Allocate 50% for fixed costs, 30% for discretionary spending, and 20% for savings and debt repayment.

Priority-based budgeting: Focus on core business functions and prioritize expenses accordingly.

3/8 Leveraging Financial Software

Financial software can be a game-changer for small business owners. Look for tools that offer:

Real-time financial tracking: Monitor cash flow, income, and expenses.

Automated budgeting: Set up budgeting rules and track performance.

Forecasting: Use historical data to predict future financial trends.

4/8 Financial Forecasting

Accurate forecasting is key to making informed business decisions. Consider:

Historical data analysis: Identify trends and patterns in your financial data.

Industry benchmarking: Compare your performance to industry averages.

Rolling forecasts: Update your forecast regularly to reflect changes in your business.

5/8 Cash Flow Management

Cash flow is the lifeblood of any business. Optimize your cash flow by:

Managing accounts receivable: Implement efficient invoicing and payment systems.

Streamlining accounts payable: Negotiate payment terms and prioritize expenses.

Maintaining an emergency fund: Set aside 3-6 months' worth of expenses.

6/8 Financial Ratio Analysis

Financial ratios can provide valuable insights into your business's performance. Track:

Debt-to-equity ratio: Monitor your business's leverage and risk.

Return on investment (ROI): Evaluate the performance of individual investments.

Current ratio: Assess your business's liquidity and ability to meet short-term obligations.

7/8 Financial Planning for Growth

As your business grows, your financial planning should too. Consider:

Hiring a financial advisor: Bring in expert guidance to help navigate growth.

Implementing a financial dashboard: Track key metrics and make data-driven decisions.

Developing a growth strategy: Align your financial planning with your business goals.

8/8 Take Control of Your Finances

By implementing these sophisticated financial planning strategies, you'll be better equipped to navigate the complexities of small business ownership. Remember, financial planning is an ongoing process – stay informed, stay adaptable, and stay ahead of the competition. SmallBusiness FinancialPlanning GrowthHacking

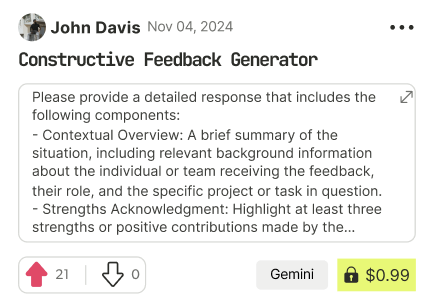

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!